A Homeowner's Guide to the

HOA Collection Process in Florida

November 24, 2025

Understanding the 7-Stage Legal Process from Delinquency to Foreclosure

⚠️ Legal Disclaimer

This guide is for educational purposes only and does not constitute legal advice. It is designed to help homeowners understand the collection process and the financial risks associated with nonpayment. For specific legal advice regarding your situation, please consult with a qualified attorney. The information provided is based on Florida Statute 720 and Surrey Ridge governing documents as of November 2025.

This guide provides a comprehensive overview of the legal process for collecting delinquent assessments in a Florida Homeowners Association (HOA). It explains each stage of the process, from the initial missed payment to a potential foreclosure, and details how associated costs and fees can significantly increase the total amount due. The process is strictly governed by Florida Statute 720, also known as the Homeowners' Association Act.

Part 1: How Payments Are Applied (The Waterfall)

The first and most critical concept to understand is the mandatory payment application order, often called the "waterfall." As required by Florida Statute 720.3085(3)(b), any payment received by the HOA must be applied in a specific sequence. This rule is not optional and cannot be changed by the HOA or the homeowner.

The Mandatory Order of Payment Application

- Interest: Any accrued interest on the delinquent balance is paid first.

- Administrative Late Fees: If authorized by the association's governing documents, any late fees are paid next. (Note: The Surrey Ridge Community Association bylaws do not authorize late fees).

- Costs and Reasonable Attorney Fees: Any legal costs or attorney fees incurred by the association in the collection process are paid third.

- Delinquent Assessments: The original unpaid HOA assessments (dues) are paid last.

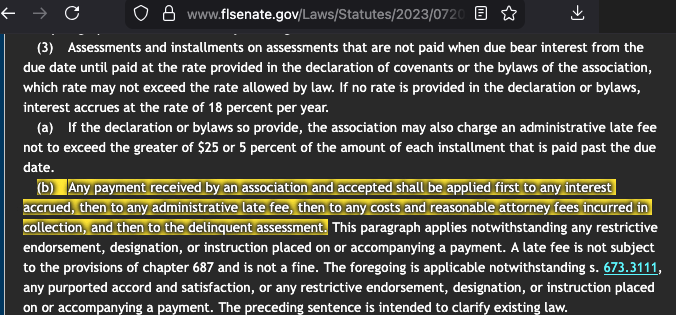

Full Text of Florida Statute 720.3085(3)(b):

"Any payment received by an association and accepted shall be applied first to any interest accrued, then to any administrative late fee, then to any costs and reasonable attorney fees incurred in collection, and then to the delinquent assessment. This paragraph applies notwithstanding any restrictive endorsement, designation, or instruction placed on or accompanying a payment."

Source: Florida Statute 720.3085(3)(b) - The highlighted text shows the mandatory payment application order

⚠️ Critical Understanding

This means that until all accrued interest and legal fees are paid in full, no portion of a payment will be applied to the homeowner's base assessment balance.

Part 2: The Stages of HOA Collection

When an assessment is not paid on time, it triggers a 7-stage legal process that adds significant costs to the homeowner's account. The following table outlines the typical progression.

| Stage | Trigger | Key Action | Typical Cost | Balance Impact |

|---|---|---|---|---|

| 1. Delinquency | Assessment is not paid by the due date. | Interest begins to accrue at 18% APY. | $0 (initially) | Interest adds to the balance daily. |

| 2. Attorney Referral | Account remains delinquent (typically 60-90 days). | The HOA Board votes to refer the account to its attorney for collection. | N/A | Marks the start of accumulating legal fees. |

| 3. NOLA Letter (30-Day Notice) | Attorney receives the file from the HOA. | Attorney sends Notice of Lien and Opportunity to Avoid (NOLA) - a 30-day warning letter providing opportunity to resolve debt. | $150 - $250 | Attorney fees for preparing and sending NOLA are added to the balance. |

| 4. Notice of Intent to Lien | 30-day NOLA period expires without payment. | Attorney sends a separate Notice of Intent to Lien, providing 45 days to pay before lien is recorded. | $200 - $300 | Additional attorney fees are added to the balance. |

| 5. Claim of Lien | The 45-day Notice of Intent to Lien period expires without payment. | Attorney records a lien against the property in public records. | $200 - $400 | More attorney fees and recording costs are added. |

| 6. Notice of Intent to Foreclose | The Claim of Lien is recorded. | Attorney sends a final 45-day warning before filing a lawsuit. | $200 - $300 | More attorney fees are added. |

| 7. Foreclosure Lawsuit | The 45-day foreclosure notice expires. | Attorney files a lawsuit to foreclose on the property. | $2,000+ | Significant legal fees and court costs are added. |

Stage 1: Initial Delinquency

When a homeowner misses the payment deadline for a semi-annual assessment (e.g., $197.50), the account becomes delinquent. Per the Surrey Ridge bylaws and Florida Statute 720.3085(3), interest immediately begins to accrue on the unpaid balance at a rate of 18% per year.

Stage 2: Attorney Involvement

If the account remains unpaid, the Board of Directors will vote to refer the account to the association's attorney for collection. This is a critical turning point, as from this moment forward, all attorney fees and costs incurred by the association to collect the debt are legally chargeable to the homeowner's account.

Stage 3: NOLA Letter (30-Day Notice)

Once the attorney receives the file, they send a Notice of Lien and Opportunity to Avoid (NOLA) letter to the homeowner. This 30-day notice provides the homeowner an opportunity to pay the delinquent balance and avoid further legal action. The NOLA letter is a distinct document separate from the Notice of Intent to Lien.

- Financial Impact: The cost for preparing and sending the NOLA letter (typically $150-$250) is added to the account balance.

- Purpose: Provides a 30-day opportunity to resolve the debt before lien proceedings begin.

Stage 4: Notice of Intent to Lien

If the 30-day NOLA period expires without payment, the attorney will send a separate Notice of Intent to Lien as required by Florida Statute 720.3085(4)(a). This is a different document from the NOLA letter. The Notice of Intent to Lien must be sent via registered or certified mail and provides a 45-day period for the homeowner to pay the full delinquent balance to avoid having a lien recorded against the property.

- Financial Impact: The cost for preparing and sending the Notice of Intent to Lien (typically $200-$300) is added to the account balance.

- Important: This is a separate legal notice from the NOLA letter, with its own 45-day timeline.

Stage 5: Claim of Lien

If the balance is not paid within the 45-day Notice of Intent to Lien window, the attorney will prepare and record a Claim of Lien in the official public records of the county. This action formally encumbers the property, making it difficult to sell or refinance until the lien is satisfied.

- Financial Impact: The cost for drafting and recording the lien (typically $200-$400) is added to the account balance.

⚠️ Important: Understanding the Lien Amount

The dollar amount shown on the recorded Claim of Lien is only a placeholder and is NOT the amount necessary to settle your account. This placeholder amount:

- Prevents you from transferring title, selling, or refinancing without settling the debt

- Does NOT change as interest accrues and charges build up over time

- Is recorded in county records solely to encumber the property

- May be significantly different from your actual current balance

To get your actual current balance, you must contact the HOA or the attorney handling the collection - NOT the courthouse.

🏛️ About the Orange County Courthouse

The Orange County Courthouse has little to nothing to do with your account balance or clearing your debt:

- The courthouse does NOT:

- Maintain your current account balance

- Accept payments for liens

- Have authority to release liens

- Control when liens are filed or released

- The courthouse ONLY:

- Records the initial Claim of Lien when filed by the attorney

- Records the Release of Lien when provided by the attorney

- Maintains public records (available online for free)

Going to the courthouse to obtain lien documents is not a productive use of time. These documents are easily available online for free, and the courthouse cannot help you resolve your delinquency or provide your current balance.

Stage 6: Notice of Intent to Foreclose

Once the lien is recorded, the association has the right to foreclose. However, Florida Statute 720.3085(5) requires the attorney to first send a Notice of Intent to Foreclose. This serves as a final warning and provides another 45-day period for the homeowner to pay the full balance (which now includes all accrued interest and legal fees) before a lawsuit is filed.

- Financial Impact: The cost for this notice (typically $200-$300) is added to the account balance.

Stage 7: Foreclosure Lawsuit

If the homeowner does not pay the full balance within the 45-day foreclosure notice period, the association's attorney can file a lawsuit to foreclose on the property. This is a full civil lawsuit that can result in the homeowner losing their home at a public auction.

- Financial Impact: This is by far the most expensive stage. The homeowner may become responsible for thousands of dollars in the association's attorney fees, court filing fees, and other litigation costs.

🚨 Critical Warning: The Foreclosure Cost Explosion

Based on real Surrey Ridge accounts that have gone through the foreclosure process, account balances typically increase by 250% to 450% from the pre-foreclosure balance once foreclosure proceedings begin.

This dramatic increase is due to:

- Substantial attorney fees for filing and prosecuting the lawsuit

- Court filing fees and legal costs

- Continued interest accrual at 18% per year

- Additional legal work required throughout the foreclosure process

The entire purpose of this guide is to help you understand the cause-and-effect relationship and the severe financial risks associated with allowing a delinquency to progress to foreclosure.

⚠️ Once foreclosure begins, your balance can increase by 2.5 to 4.5 times the amount you owed before filing.

Conclusion: The Importance of Early Action

This guide illustrates how a single missed assessment can quickly escalate into a significant financial liability due to the compounding effect of interest and legally mandated attorney fees. As demonstrated by real Surrey Ridge accounts, balances can increase by 250-450% once foreclosure proceedings begin. The Florida Statutes provide a clear but unforgiving process for collections. It is always in the homeowner's best interest to address delinquencies as early as possible to avoid the substantial costs associated with the later stages of the collection process.

📊 The Financial Escalation Pattern

| Collection Stage | Typical Impact on Balance |

|---|---|

| Stage 1: Initial Delinquency | Interest begins accruing at 18% per year |

| Stages 2-6: Pre-Foreclosure Collection | Attorney fees and costs accumulate ($600-$1,400 typical range) |

| Stage 7: Foreclosure Filing | Balance increases by 250-450% from pre-foreclosure amount |

Key Takeaway: The cost of inaction grows exponentially. Once foreclosure proceedings begin, the balance can increase by 2.5 to 4.5 times. Early communication and payment can save you thousands of dollars.

💡 What Should You Do?

If you're facing financial difficulty and cannot pay your assessment on time:

- Contact the Board immediately at board@surreyridgehoa.org

- Request a payment plan before attorney involvement begins

- The earlier you communicate, the more options you have

- Once attorney fees start accumulating, the debt grows rapidly

References

[1] The Florida Senate. (2023). Chapter 720, Section 3085 - 2023 Florida Statutes. Retrieved from https://www.flsenate.gov/Laws/Statutes/2023/0720.3085

Surrey Ridge Community Association, Inc.

This guide is provided for educational purposes to help homeowners understand their rights and obligations under Florida law.

This is not legal advice. For specific legal guidance, consult with a qualified attorney.